Caltech physicist David Goodstein sees little hope for hydrogen, which he said requires fossil fuels in order to extract. And natural gas, like oil and coal and shale (another proposed alternative) are all finite.

Goodstein puts little stock in nuclear fusion. It doesn't matter so much when we run out, he argues, but what we do about it. He predicts a looming world crisis that could fuel war and bring society to its knees.

Stanford University geophysicist Amos Nur predicts the potential for war. None of the roughly 500 scientists in the room voiced disagreement with Nur.

(Out of Gas: The End of the Age of Oil by David Goodstein W.W. Norton & Company)

http://www.livescience.com/3754-oil-fuel-civilization.html

Crude oil production will peak in 2014

Scientists from Kuwait University and Kuwait Oil Company are forecasting that world conventional crude oil production will peak in 2014—almost a decade earlier than some other predictions. The world oil reserves are being depleted at an annual rate of 2.1%.The amount of recoverable OPEC oil is 909 BSTB (billion barrels) or which is about 78% of the world reserves.

Non-OPEC countries have already reached their peak production in 2006.

The amount of recoverable non-OPEC oil is 252 BSTB (billion barrels) or 22% of the world's reserves being depleted at an annual rate of 5.6%.

The US uses about 7 billion of the 30 billion barrels of oil produced annually around the globe. The United States now imports nearly 60 percent of the oil it uses. Oil consumption equals standard of living.

China uses a comparatively modest 1.5 billion barrels a year (perhaps 2.4 billion this year) according to some estimates. India consumes less. China's consumption is expected to grow 7.5 percent per year, and India's 5.5 percent.

Both countries' economies are becoming increasingly dependent on oil, however.

http://www.q8nri.com/home/2010/03/10/kuwaiti-researchers-predict-peak-oil-production-in-2014/

Oil is fundamentally a depletable resource – once a barrel is extracted from the ground and burned, it is gone. Nevertheless, world oil production has continued to increase steadily for the last century and a half. Most economists attribute this to technological progress. Each year our methods for finding oil become more sophisticated, and our extraction methods more efficient. Unquestionably this progress has been quite remarkable, with oil now being produced by wells that begin a mile below the surface of the sea and proceed for several more miles through rock to get to the oil-bearing formations.

Brief History of Oil Production

Technological progress is not the only reason that oil production has increased over time. The industry was born in the Oil Creek District of Pennsylvania in 1859. Figure 1 shows annual crude oil production for the states of Pennsylvania and New York since then. Production from the original Oil Creek District reached its maximum level in 1874, and total production from the two original oil states peaked in 1891. There was a resurgence of production as a result of secondary and tertiary recovery methods developed in the 1920s, though these were never enough to return production to where it had been in the 19th century.

This, however, was not the end of the U.S. oil industry. Even as production from the original fields in Pennsylvania was on the way down, production began in neighboring Ohio, where it did not peak until 1896, and West Virginia, which peaked in 1900. When you look at production from the United States as a whole (which in the 19th century was primarily these three states), it seemed to increase steadily from 1859 to 1900, as increases in new regions made up for declines in the original.

Despite the depletion of the Appalachian fields, U.S. production was to continue to increase as we entered the 20th century. This was achieved by a migration of the industry to new producing areas such as Illinois and Indiana (which would not peak until 1940), Kansas-Nebraska (peaked in 1957) and the four-corner states of the American Southwest (peaked in 1960), all of which proved to be far better places for obtaining oil than Appalachia. As production from these areas went into decline, even better fields were found in what ultimately proved to be the United States’ four most productive states – California, Oklahoma, Texas and Louisiana – whose respective production peaks in 1985, 1927, 1972 and 1971 are seen in Figure 2.

Oil Production Today

Right now there is considerable excitement about the potential for new horizontal fracturing methods to free oil from shale and other tight formations that traditionally had been inaccessible. This technological innovation is producing impressive production gains in places such as North Dakota and Texas; however, despite these gains, U.S. crude oil production in 2011 was still less than 60 percent of what it was in 1970. And a key unknown is how quickly production is likely to decline after the initial surge. The North Dakota Department of Mineral Resources estimates that production from a given fracking well will decline 80 percent within two years of initial production.But despite the fact that U.S. oil production today is far below its level of 40 years ago, world oil production increased 33 percent between 1973 and 2010. Here again the story is one of development of new areas. These include the North Sea and Mexico, which went from 1 percent of world production in 1973 to 13 percent in 1999; however, the North Sea is now only producing at about half of its 1999 level, and Mexico is down 25 percent from its peak in 2004.

The Future of Oil Production

Other regions, such as central Asia, Africa, and Brazil continue to increase, and the government of Iraq is optimistic that quite substantial production gains can still be achieved there. These helped offset the North Sea and Mexican declines so that world production in 2010 was about at the same level as in 2005, and started to increase again in 2011 and 2012.My view is that with these new fields and new technology, we’ll see further increases in U.S. and world production of oil for the next several years. But, unlike many other economists, I do not expect that to continue for much beyond the next decade. We like to think that the reason we enjoy our high standard of living is because we have been so clever at figuring out how to use the world’s available resources. But we should not dismiss the possibility that there may also have been a nontrivial contribution of simply having been quite lucky to have found an incredibly valuable raw material that was relatively easy to obtain for about a century and a half.

My view is that stagnant world oil production and doubling in the real price of oil over 2005-2010 put significant burdens on the oil-consuming economies. Optimists may expect the next century and a half to look like the last. But we should also consider the possibility that it will be only the next decade that looks like the last.

Nate Hagens

Dear President Obama,

Let me start by explaining where I am coming from. Until a few years ago, I worked as a Wall Street trader and hedge fund manager. I am now finishing a PhD. in Natural Resources from the University of Vermont with a specialization in Ecological Economics. I am neither capitalist nor communist nor Republican nor Democrat, but just a concerned citizen of this country and this planet. I have recently come to see that there is a great deal hidden from view both about our energy resources and our energy consumption. In this letter, I would like to explain what some of these things are. In addition to this overview, there are over 3,000 essays and analyses in theoildrum.com archives, written by a staff of extremely bright civically minded volunteers, outlining the myriad energy challenges and opportunities we face.

INTRODUCTION

Imagine two scenarios - 1) In the first 2 years of your presidency, the US Treasury 'prints' $100 trillion** of new 'capital' to be spent on infrastructure, reviving the economy, etc. - far in excess of the $1.2 trillion budget deficit you expect to incur in 2009 (and even in excess of the $24 trillion the IEA has suggested needs to be spent to assure future oil flows) - and 2)Instead of issuing this new debt, all the world's billionaires and nations in monetary surplus donate this $100 trillion to the US Treasury – effectively for you/Congress to spend and allocate.

In the second scenario, we are not only out of hock but rich again! All problems solved right? DJIA 30,000? Not so fast - there is another important fact connected to this thought experiment. The energy surplus (gross energy less energy costs) we derive from world fossil fuels is declining, possibly approaching energy break-even for new fields in the US. It requires about 245 kilojoules to lift 5kg of oil 5 km out of the ground - a physical (minimum) fact that will not vary whether the number of digits in the worlds banks increases or shrinks. As such, the above two scenarios would both be equally ineffective at reviving the economy for any period of time- even with plenty of 'money' - the first would likely just add an extra digit or two to the nominal lack of goods affordability. Energy and natural resources are what we have to spend - in the long run a transfer of money from rich to poor (or vice versa) is just a transfer of one abstraction to another abstraction - those altruistic billionaires will feel poorer and the government dole recipients will feel successfully bailed out, but the real assets constraining future trajectories didn't change. In the (very) short run however, whoever holds the money, does control the energy. Due to our belief in fiat, short run changes to monetary system (rules, leverage, margin, debt, derivatives, etc), CAN increase the energy spigot. But at a steep price.

Oil Supply Costs Based on CERA Analysis - From Horizon Energy November Investor Presentation

-Click to Enlarge

ENERGY QUANTITY

Our society survives as any living organism does, on top of harnessing daily solar ecosystem services we convert carbon from a low state of entropy to a higher state of entropy and live off the heat produced by the reaction. The easy carbon (fossil fuel) pickings have largely been picked. Though costs have been coming down in past few months, the above graph gives a flavor of the problem that until recently the IEA/CERA/Bodmans of the world would not voice - the horizon of overall affordability for social democracies is receding, and though the manifestation may be in currencies and debt, the origins are in energy / natural resources. The average replacement cost of oil is far in excess of the current commodity price, especially in non-OPEC countries. To increase reserves and maintain flow rates, we must drill in the oceans, off continental shelves, use expensive horizontal laterals, drill deeper and in more environmentally sensitive areas and define more things as oil. Technology is always in a race with depletion, and in the late innings loses at an accelerated rate (due to complexity). Because of this, costs have risen much faster than revenues. The fact that US oil and gas stocks have plummeted while oil is still 400% higher than a decade ago, is suggestive we are far closer to energy break-even than the DOE or API might admit, and $ break-even will occur before energy break-even. The heavy economic lifting so long undertaken by the energy sector will soon need help from the rest of 'productive' society, or from exporting countries which face similar problems. With new investments being unaffordable and/or unfinanceable, the global oil production rate will increasingly align with it's natural decline rate - approaching 7-8% and rising as small/offshore fields replace giant/onshore ones. This suggests even with current deflationary forces due to credit unwind, we likely have a few short years before depletion again overtakes even reduced demand, and this time, there will be no new peak in supply when prices rise. If the economic system remains intact, we will have a series of high amplitude price swings in oil and natural gas, getting sharper and shorter as depletion/high costs dominate. Indeed, it is probably the slope of the net energy cliff which will shape our future more than anything else (assuming social stability is maintained through paper currency reform). Essentially, Mr. President, though there is undoubtedly a great deal of oil and gas remaining, a lower aggregate energy surplus means it may cost more to procure than society has the ability to pay, at least in the currencies that matter: energy and other limited natural resources. (An example of a hypothetical society encountering lower energy surplus can be read here). Debt and cheap energy have allowed positional goods consumption to increase for the majority of Americans who are not in the top tiers of society -without cheap energy or available (fiat) credit, the camouflaged social barriers within our country are likely to fade away.

High quality, low cost energy has enabled our economic engine, and kept our social democracy intact. There is a high correlation between energy consumption per person and GDP over the past 50 years. If energy costs continue to increase in energy terms, even with trillions of new credit injected via your government entities, it will eventually require more in energy inputs to procure a new barrel of oil from domestic territory than the amount of joules contained in that barrel. Of course, most energy 'analysts', trained in economic concepts will say 'all we need is $30,40,50 trillion and we will have enough energy for decades'. Don't fall for it Mr. President. At some point between $1.2 trillion and the $100 trillion thought experiment, even Rush Limbaugh and Larry Kudlow will recognize that ‘money’ can't procure ‘resources’. Marginal costs of growth now likely exceed marginal benefits, so that real physical growth makes us poorer, not richer. Bite the bullet now and admit that growth was great while it was possible, but now each additional trillion you create from thin air to feed the current constituency, makes their childrens future so much worse. Without increases in energy we cannot grow (unless we conserve or become more efficient), without growth we cannot repay debt, without debt we won't finance future energy development. And every additional debt dollar is already adding less and less to GDP. The sooner we educate policymakers about this constraint the better choices we will make - Energy and scarce resources are what we have to spend – money is just who has the energy (for now).

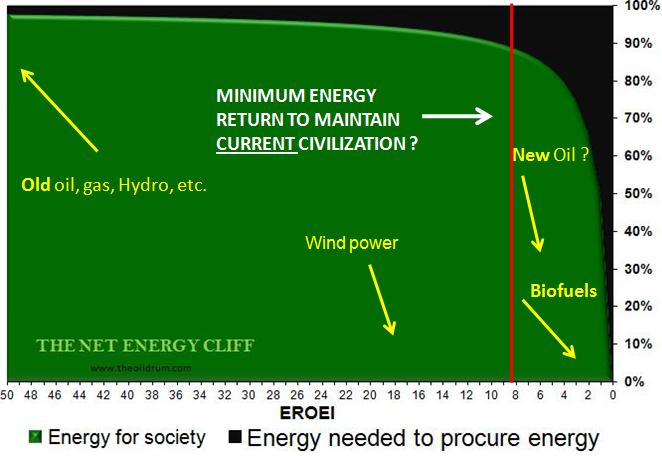

The fundamental principles of net energy are ignored by most in Washington (and the energy industry) where costs in terms of dollars and market signal via current price have been the lone decision criteria that have brought us to this energy precipice. The energy return on the energy we are spending is declining, possibly rapidly (we can only estimate these figures because data is no longer kept in non-$ terms). As we replace 'old, high energy surplus' sources with 'new, lower energy surplus' alternatives, our energy cash flow decreases. At some minimum aggregate threshold (red line in graph), the entire surplus is spent on maintenance, repair, etc. and there can no longer be growth - I believe we are past this point. (We do know we've gone from over 100:1 in the 1930's to 30:1 in the 1970s to a range of 10-17:1 in 2000 (primer) and something anecdotally much less today (note: this is total energy return, which is fixed plus marginal - marginal costs for oil are very low -basic lifting and some labor-, raising the possibility we are in the midst of a stealth energy cliff -since most energy infrastructure was built and paid for when oil/natural gas prices were low, we are still 'spending' the cheap marginal flow rates from earlier days, even though we can't afford their replacements!) It is logical that financial analysts, or even presidents, don't start to notice our decline in physical return until the lack of continued energy surplus eats into the economy, forcing the 'profit' to be made up different ways (no-doc loans, leverage for banks, easy credit, etc.) - essentially in abstract ways not tethered to anything physical. Lead into gold but in reverse. The situation is even more dire on the natural gas treadmill, as it is largely a domestic market, overall decline is approximately 40% per year, and the commodity price is far below both average and marginal cost. Drilling and exploration will crash befor your Presidency ends, and production with it.

-Click to Enlarge

In a sentence, we have lots of energy, but not enough cheap energy to continue a social democracy 300 million strong pursuing growth and possessing the claims and aspirations they believe are theirs.

(*Note In the Journal - Energies, there is an upcoming paper by Hall, Murphy et al. titled "What is the Minimum EROI that a Sustainable Society Must Have?" that looks at the above concepts in greater detail.

ENERGY QUALITY

Modern society has been built and developed not only on a large annual energy surplus, but also become dependent on specific energy properties. Light sweet crude oil is incredibly energy dense, transportable at room temperature, and can be procured from a very small land footprint -drilling under the earths surface. Energy quality, such as differences in power density, gravimetric and volumetric density, conversion efficiencies, intermittency, storability, environmental externalities, spatial distribution, transportability, etc. is not equal - even (and especially) because an energy alternative is labeled as 'green'. A successful energy transition will match up the energy asset/liability balance sheet of our built infrastructure. The new post-fossil fuel era will require huge changes, as the mismatch currently is so large as to be virtually impossible once depletion catches up with the fall in demand (barring a wartime scaling of nuclear/(thorium?) plants).

Finally, Energy Return on Energy Invested(EROI or ERoEI) times scale added up over energy types gives us a rough idea of our energy budget, but we can (and should) calculate similar ratios for other limiting resources – Energy Return on Water Invested, Energy Return on Land invested, etc. As net energy declines, it stands to reason that the Energy return on NON-ENERGY inputs will decline faster. (Examples are going from concentrated light sweet oil fields to tar sands, needing both more land, and water inputs – ditto with biofuels.) Once we approach and sink into a single digit average EROEI era, a higher % of energy AND non-energy resources (water, labor, land, etc.) will have to be devoted to energy production. This is the as yet unseen tragedy of biofuels and similar low energy gain technologies. On the surface, they seem better (renewable), but a) the inputs allocated to their procurement previously generated far more energy - (returns that are no longer available yet continue to be spent being the key point), b) they require more land, water, NPK, and generate negative externalities (large scale windpower a notable exception). Each attempt to buttress the energy supply side of our situation should be measured in a multi-criteria framework.

DEBT

Debt serves as a spatial and temporal re-allocator of goods and services from the future and periphery to the present and center. In every single year I've been alive, our country has increased its debt more than we grew our output. The amount of debt, depending on assumptions is north of $60 trillion, and over $100 trillion if we include unfunded social security and medicare benefits. Austerity measures and new social goals are what are called for, yet the growth treadmill demands constant new debt issuance to service the aggregate of prior claims or the whole house of cards implodes. Remember that money is created by the will of our bankers - a loan and deposit are both simultaneously willed into existence and our 'money as debt' balance sheet increases both ledgers - however the loan is issued with terms 'plus interest' so over time debt at time T requires higher output at time T+1 otherwise a deflationary cycle begins absent new aggregate credit creation. New debt that is injected into the economy, as long as it is spent somewhere on something (anything), will create GDP that wouldn’t otherwise exist. You will face this Keynesian carrot early on as a seeming answer to our problems. It is not. Keynesianism dies in the face of resource depletion and net energy decline. New (net) debt at the end of a paradigm will feed hungry mouths but at a cost of destroying our currency. I should point out you are not alone in facing this problem. Essentially the whole developed world creates leveraged credit without tether.

Supply side summary ===> Maximize the quality adjusted, non-energy input equalized, 'energy cash flow'. This is your real 'budget'. (A stricter, 'greener' budget would also internalize the externalities.) In order to do this you need to get away from people measuring 'wealth' in digits. As seen below, this will not be easy, but certainly is doable.

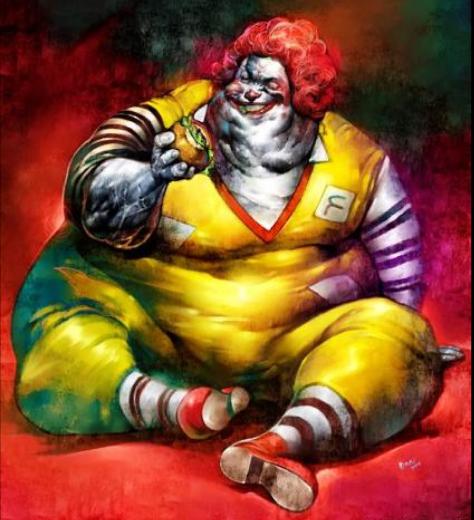

THE BIG KAHUNA (DEMAND)

Our species in general and Americans in particular have the wiring and drive to be consumptive machines. No matter how many goods we acquire over time, our pecuniary desires seem to increase faster than our acquisitions. Combine this with our mirror neurons(video), between-and-within-nation aspiration gaps (based on biologic underpinnings of relative fitness), an evolutionary penchant for waste, a built in drive to outcompete, a culture that fosters keeping up with the Joneses with a high % of Veblen goods, and the result is a frenetic feedback loop that has a vast plurality of Americans now Jonesing, many nearly broke, obese, and a fair number realizing, without knowing the details, that something is amiss. Alternative measures of 'keeping score' other than GDP concur that we are losing ground. Fortunately, subjective well being studies show we are equally happy as the average Phillipino, yet use 39 times the primary energy. This I view (as should you) as a great opportunity. In the end, humans are 'adaptation-executors', not utility maximizers. (This is really an ace in the hole - because it strongly suggests we do not need the economic 'utility' machine to make us happy).

Facing our bigger problems requires that we individually and collectively become better able to consider and more heavily weight the future vis-a-vis the present. However, recent research suggests that addicts, and many other social groups (including men), have steeper discount rates - less able to access longer term thinking and action. Furthermore, there are numerous cognitive biases, ideological immunity (the Planck Problem), and belief systems that stand in the way of change.

Demand Side Summary===> We are hard-wired to compete, and our brains are easily hijacked and confused by modern stimuli. Both these aspects lead to incredible wastes of energy and resources. It is the most politically difficult area, but also the one with lots of low hanging fruit.

CONCLUSION AND SOME SUGGESTIONS

We are trained to believe that "money" is to the economy what "energy" is to the physical world. Your current advisers extrapolate what is "economically" possible to be "physically" possible too - but this is patently untrue. If energy is what we have to spend, we are even running more of a deficit that commonly known. We import 70% of our oil and pay for it with dollars. Someday soon someone will recognize this trick. "Replacing" this quantity and quality of energy is not possible, nor affordable by a long shot. Admit this, devote resources to accurately determining what our energy and natural resource principal and cash flows are and then make difficult choices on how to allocate these. A great many marginal industries are going to have to be stopped. Greener substitutions will require multi-criteria analysis: e.g. a move from ICE to electric cars would still need to consider the metals used and the significant water requirements vis-a-vis what they replace.

A birds-eye view will see our system as little more than satisfying short term cravings, turning resources rapidly into garbage, and concentrating wealth claims in fewer and larger hands. Repeat every day. Wealth itself is not bad, but a social democracy will stretch only so far in its GINI coefficient before snapping - (look to some European peers for (more) successful models). From a prescriptive standpoint, looking beyond putting out the presidential short term fires du jour, the long term strategy should be some sort of Ecological Keynesianism, that is, spending of financial capital to best maximize future real capital. If we can’t get enough current flow rate from surplus energy we will borrow from poor countries, from environments, and increasingly, from the future.

The demand side is where the real opportunities lie: the main points are that we need to understand why humans behave the way they do, otherwise we are not going anywhere. Missing on your staff are neuroscientists, behavioral economists, and evolutionary psychologists – three disciplines that will eventually, given time and energy, converge on a unified theme of human nature. One driver that is already clear is that we cannot change our neural drive to want ‘more’ – but we can, via cultural transmission, via example and via strong visionary leadership, change how we ‘define’ more.

Here is a sampling of some ideas that may help. As radical as some may seem, these are the types of steps needed to turn in the right direction. Almost by definition they are all politically untenable, but that is the point we have reached:

1) Put a floor on energy prices. The marginal barrel is killing future production. However, wait 6 months or so in doing this. Then the market will show you how many of these 'alternative energies' are actually viable, given that we don't have accurate energy input output data. However, if oil (and particularly natural gas) prices remain below average cost for long, depletion is going to accelerate beyond what we can judiciously manage.

2) Scale wind turbines everywhere that they can be scaled, particularly those places with offsetting hydro-electric backup. On a long term basis they are a far better investment than new money towards oil or natural gas, provided that updating the grid receives commensurate attention. But that means moving away from liquid fuels in a timely fashion and eventually moving away from 24/7 365 electricity on demand. (Wind has added benefit of not increasing water requirements for electric vehicles)

3a) Focusing energy policy and social change on anthropogenic global warming is at best a half-measure and at worst could have negative repercussions, for two reasons: First, if there is a cold winter or three for whatever reason, and in a period of severe economic hardships high quality energy is being used to mitigate GHGs that might be spent on other needs then the populace may quickly lose their buy-in to carbon taxes etc. and behavioral changes that were enacted DUE to global warming. But more importantly: it removes focus and responsibility from the larger problems we face: as long as we compete for conspicuous consumption, the non-GHG externalities from more consumption will increase to offset GHG reduction policies (kind of like quitting drinking and taking up sugar – 'serotonin deficiency' is root cause, not alcoholism). In sum, we should definitely be concerned about our impact on planetary ecosystems (our nest) and what toxins we emit, but this should be part of a larger science based roadmap not the entire roadmap. This will have the positive externality of mitigating climate change as well! In a sentence, we can't fight AGW by compromising our energy predicament, but can fight both by reducing consumption.

3b) On the spectrum of carbon taxes, cap and trade ,etc. consider gradually introducing a consumption tax instead. Subsidize basic needs and severely tax Veblen goods.

4) Gradually move to 100% reserve requirements in the banking system and once a new social goal other than GDP is set, eliminate the Basel II haircut advantages for sovereign, AAA debt etc. Creating money (and debt) only partially out of thin air is preferable to completely out of thin air. .

5) Our behaviour and ability to plan for the future is impacted by the poor nutrition most accessible in our current food system. We need healthier choices in our schools, convenience stores and supermarkets, perhaps even a subsidy for growing home gardens. In addition to an obesity epidemic that is accelerating, sugar has now been shown to be a gateway drug (Hoebel, Princeton) and chronic use results in lowered serotonin levels which in turn increases discount rates which has been shown to increase our focus of thinking about what they want/need today at a cost to the future. Exactly the opposite of what we need to impact longer term sustainability. (So a meaningful chunk of both basic needs procurement and behavioural change can be accomplished by moving away from industrial agriculture/ processed food and towards more locally intensive, whole food production). If we can't grow the food locally and provide appropriate nutrition, I would consider taxing or eliminating altogether refined sugar products, and refined carbohydrate foods in our grocery stores and convenience stores. Instituting national exercise programs (like in Naperville IL), would also pay neural dividends. America has lost the ability to wait for the second marshmallow, and our diets are at least partially to blame.

6) In the same vein, biophysical facts are going to require economic triage - some businesses and sectors are going to have to go. Consider directing this inevitability by taxing or eliminating any industry promoting products that lead to addiction, making us culturally less able to act for the long term; e.g. the gambling industry, Indian casinos, Vegas, online poker rooms, etc. The easy access millions of young people worldwide have to online poker contributes (as do many things) to hijacking our neural dopamine highways, which we then habituate to and consume more in other areas. People will continue to gamble anyway, but at least the revenues will filter locally. Most neuroscientists and evolutionary biologists would agree we are not 'intelligent' enough to overcome the smorgasbord of impulses offered. I recommend reading "American Mania" by Dr Peter Whybrow at UCLA or contacting him directly. In a sentence, in addition to positive examples, we're going to need negative reinforcements as well. Sticks and carrots, directed away from waste and towards primary needs. It has been done before.

7) Eliminate leverage on Wall Street. Yes, this will remove 'income' opportunities, but it will deter future volatility, and inherently transfer human talent into more productive sectors Derivatives are creative ways up squeezing more social amplitude out of nothing, by creating nothing and the vast majority aren't helping manage future risks but enlarging them.

8) I expect you will soon advocate a large fiscal stimulus program. Instead of $500 stimulus checks that will be spent on short term stuff, please consider something out of the box, like gifting a quality bicycle to each American instead. Bicycles are the most energy efficient invention known to man, better than walking, far better than driving, and slightly better than a full double decker bus. They represent a long-term investment in energy infrastructure, improved health, and a statement of change. Those too young, old or infirm to use the bicycles can trade them for other necessities, but the bikes will be out there, as part of future energy savings. If this is too radical, perhaps start by giving corporate tax incentives for those who bike to work.

Please take seriously the task of matching our real assets with our real liabilities as soon as possible. You are a very smart man and well understand the implications of acting later as opposed to sooner on these tough choices, when our liabilities have increased and our assets have shrunk. Just ahead of us is a waterfall that few can clearly see. Even our scientists are focused on measuring the water speed, distance to the waterfall, building bigger canoes and larger life preservers, etc. But one path that hasn't been duly considered, is just paddling towards shore, and walking the rest of the way. You're the President, so if anyone in politics can resist the pressure to conform, you can.

Yes we can, but we need to use lateral thinking, be realistic, and be bold.

Sincerely,

Nate Hagens

Gund Institute for Ecological Economics

Rubenstein School of Environment and Natural Resources

Editor - www.theoildrum.com

P.S. If ever in doubt, Herman Daly is just a cab ride away.

No comments:

Post a Comment